Expert Assistance: Bagley Risk Management Methods

Expert Assistance: Bagley Risk Management Methods

Blog Article

How Livestock Danger Defense (LRP) Insurance Policy Can Protect Your Animals Financial Investment

In the realm of animals financial investments, mitigating risks is extremely important to making certain financial security and growth. Animals Risk Defense (LRP) insurance coverage stands as a trustworthy guard versus the uncertain nature of the marketplace, supplying a strategic method to securing your assets. By delving right into the details of LRP insurance policy and its diverse advantages, animals manufacturers can strengthen their financial investments with a layer of security that transcends market variations. As we explore the realm of LRP insurance policy, its duty in safeguarding livestock financial investments comes to be increasingly obvious, guaranteeing a path towards lasting economic strength in an unstable sector.

Comprehending Animals Risk Protection (LRP) Insurance Policy

Comprehending Livestock Danger Defense (LRP) Insurance coverage is essential for livestock manufacturers seeking to alleviate financial risks connected with price fluctuations. LRP is a government subsidized insurance item developed to shield producers against a decrease in market rates. By offering protection for market value decreases, LRP helps manufacturers lock in a floor price for their animals, ensuring a minimal level of revenue no matter market variations.

One secret facet of LRP is its adaptability, permitting manufacturers to personalize coverage levels and plan lengths to suit their details requirements. Manufacturers can choose the number of head, weight array, insurance coverage rate, and protection duration that align with their production goals and run the risk of resistance. Comprehending these customizable options is crucial for producers to properly handle their rate risk direct exposure.

In Addition, LRP is readily available for numerous animals kinds, consisting of cattle, swine, and lamb, making it a flexible threat monitoring device for livestock producers throughout various fields. Bagley Risk Management. By acquainting themselves with the intricacies of LRP, producers can make educated decisions to secure their financial investments and make certain monetary stability despite market uncertainties

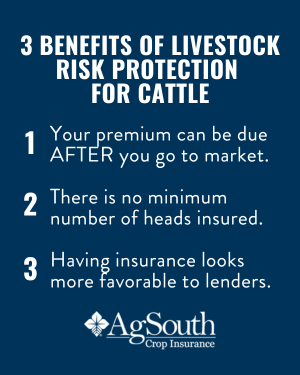

Benefits of LRP Insurance Coverage for Livestock Producers

Livestock producers leveraging Animals Danger Defense (LRP) Insurance policy get a calculated advantage in securing their financial investments from rate volatility and protecting a steady economic ground among market unpredictabilities. By setting a flooring on the price of their livestock, producers can minimize the risk of considerable monetary losses in the event of market downturns.

In Addition, LRP Insurance policy provides producers with assurance. Recognizing that their investments are guarded against unanticipated market modifications permits manufacturers to concentrate on various other aspects of their business, such as improving pet wellness and welfare or maximizing production processes. This peace of mind can result in increased efficiency and earnings in the lengthy run, as manufacturers can run with more self-confidence and stability. In general, the benefits of LRP Insurance coverage for animals manufacturers are significant, offering a valuable tool for managing risk and guaranteeing monetary safety in an uncertain market setting.

How LRP Insurance Policy Mitigates Market Threats

Minimizing market dangers, Livestock Risk Protection (LRP) Insurance policy gives animals producers with a reputable shield versus rate volatility and monetary unpredictabilities. By using security versus visit unforeseen price drops, LRP Insurance assists manufacturers secure their financial investments and preserve monetary security despite market fluctuations. This sort of insurance policy permits animals manufacturers to secure a rate for their animals at the beginning of the policy period, ensuring a minimal rate level no matter of market adjustments.

Actions to Protect Your Animals Investment With LRP

In the world of farming risk administration, carrying out Livestock Threat Security (LRP) Insurance coverage involves a critical procedure to safeguard investments versus market fluctuations and uncertainties. To secure your livestock investment successfully with LRP, the initial step is to evaluate the certain threats your operation encounters, such as price volatility or unexpected weather condition events. Next, it is critical to research and select a respectable insurance policy supplier that supplies LRP plans customized to your livestock and organization requirements.

Long-Term Financial Protection With LRP Insurance

Guaranteeing enduring financial stability via the usage of Animals Danger Protection (LRP) Insurance is a prudent long-lasting strategy for farming manufacturers. By including LRP Insurance into their danger administration strategies, farmers can guard their animals financial investments against unforeseen market variations and negative occasions that might threaten their monetary wellness with time.

One trick advantage of LRP Insurance coverage for lasting economic protection is the satisfaction it uses. With a trustworthy insurance coverage in position, farmers can reduce the monetary threats linked with unstable market problems and unexpected losses as a result of elements such as condition outbreaks he has a good point or all-natural disasters - Bagley Risk Management. This stability allows manufacturers to focus on the daily procedures of their animals organization without continuous fret about prospective economic troubles

In Addition, LRP Insurance policy provides an organized technique to managing risk over the long-term. By setting details insurance coverage levels and selecting ideal recommendation periods, farmers can customize their insurance policy plans to line up with their economic objectives and take the chance of tolerance, making sure a sustainable and protected future for their livestock procedures. In verdict, purchasing LRP Insurance coverage is an aggressive technique for farming manufacturers to achieve long lasting monetary protection and safeguard their source of incomes.

Verdict

Finally, Animals Threat Security (LRP) Insurance coverage is a beneficial device for animals producers to reduce market dangers and protect their financial investments. By comprehending the advantages of LRP insurance policy and taking actions to this website execute it, manufacturers can attain lasting economic safety and security for their procedures. LRP insurance policy offers a safeguard versus price variations and makes certain a degree of security in an uncertain market setting. It is a smart option for securing livestock financial investments.

Report this page